Our care

Medicare is a federal health insurance program that provides health care coverage to millions of Americans who are 65 and older, and people with certain disabilities or health conditions may be eligible before they turn 65. It is designed to protect the health and financial security of those

who use it. Medicare is comprised of four parts (A, B, C and D) covering specific services, from medical care to prescription drugs.

- Part A covers hospital and nursing home care, while Part B generally covers physician services. Together, Part A and Part B are called Traditional Medicare and are provided by the federal government. Traditional Medicare covers only about 80% of medical expenses and does not include prescription drug coverage. Beneficiaries must enroll in both Parts A and Part B be to eligible for Part C.

- Part C, known as Medicare Advantage, is another way to get Part A and Part B coverage. Medicare Advantage is offered by private health plans like Kaiser Permanente, and includes an annual out of- pocket cap, reduced cost sharing, and supplemental benefits not covered under Traditional Medicare.

- Part D is voluntary prescription drug coverage that can be combined with Traditional Medicare or included in Medicare Advantage plan design and is available from private health plans like Kaiser Permanente.

With our integrated care model, Kaiser Permanente achieves better outcomes through a combination of care coordination, comprehensive data collection and use, and aligned incentives that all promote affordable, high-quality care. Specifically, The Southeast Permanente Medical Group provides the physician care, Kaiser Foundation Health Plan provides the coverage, and Kaiser Foundation Hospitals provide the medical facilities as well as nursing and ancillary care. In Georgia, we operate 27 medical offices and employ over 600 physicians.

Quality

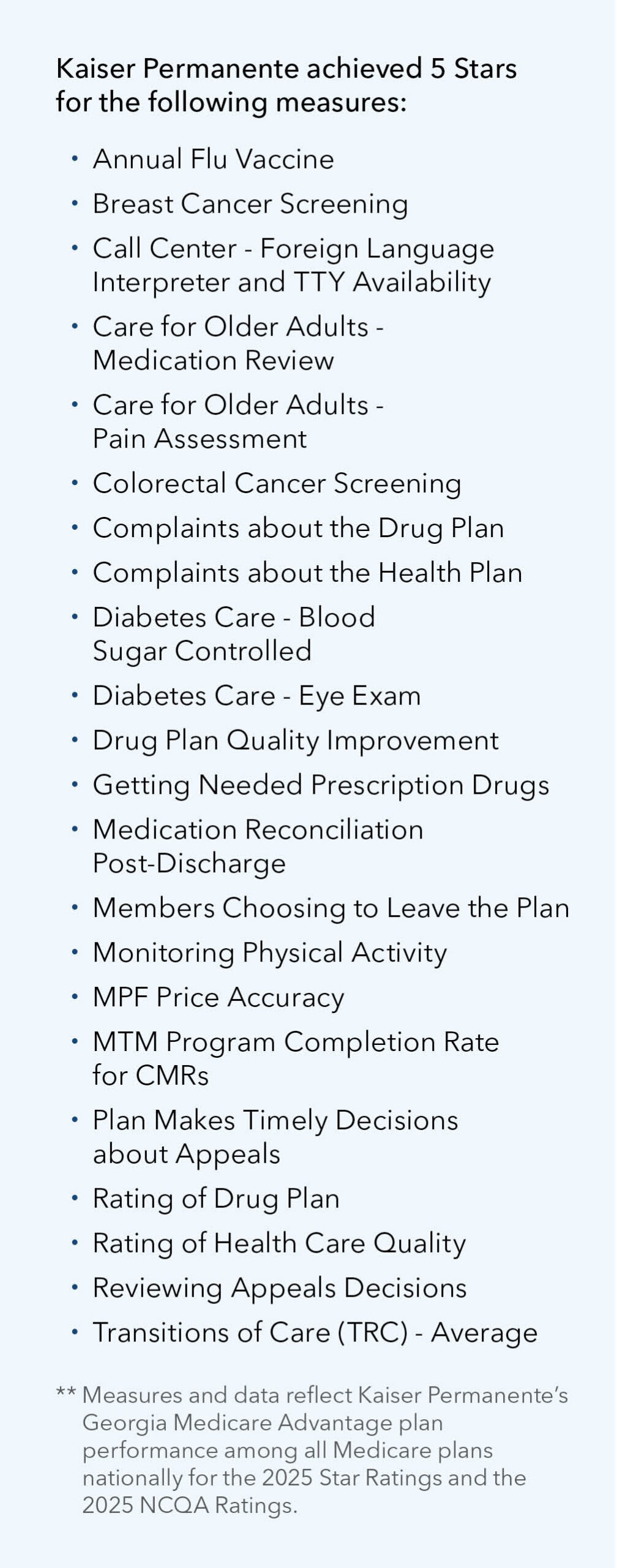

Kaiser Permanente performs highly on measures of quality and is tied for the highest rating of any Medicare individual health plan in the state, per the Centers for Medicare & Medicaid Services (CMS) 2025 Star Ratings. For 2025, Kaiser Permanente’s Medicare Advantage plan is rated 4.5 out of 5 Stars in Georgia. In addition, according to the National Committee for Quality Assurance (NCQA) we have the highest-rated Medicare Advantage plan in Georgia with a 4.5 rating out of 5.0.

Program spotlight

Kaiser Permanente provides several Medicare Advantage benefits that help improve access to care, affordability, and health outcomes for our members, especially those with the most complex needs. Key Georgia benefits include:

- Virtual care plays a pivotal role in providing convenient care to our members, including talking to your doctor or care team by phone or video from the comfort of home, scheduling appointments, viewing test results and health records, ordering prescriptions, and sending nonurgent health questions to your doctor’s office.

- Access to affordable prescription drugs is critical to supporting the health of many older adults. Our innovative approach to prescription drug coverage and purchasing for our members involves evidence-based medication selection, negotiated drug purchasing, and carefuformulary design (list of covered medications). Kaiser Permanente’s integrated model gives us the unique ability to leverage the pharmaceutical supply chain, drug formulary management, and pharmacy benefit design to control drug costs. Through these efforts, we achieve up front discounts when possible, providing our members the best possible value for their dollar.

- Supplemental benefits are items and services that plans can cover beyond those covered under Traditional Medicare, such as dental, vision, and hearing benefits. The specific benefits offered vary by plan.

- Dental, vision, and hearing aid benefits support overall health and daily functioning. Medicare members receive preventive and comprehensive dental coverage benefits. Preventive care typically includes services like routine oral exams, cleanings, X-rays, and more. Comprehensive dental care typically includes a range of services beyond routine preventive care, such as restorative services, endodontics, and periodontal treatments. Medicare members receive an allowance touse toward the purchase of eyeglasses or contact lenses. Medicare members enrolled in certain plans for those dually eligible for Medicare and Medicaid also receive an allowance to use toward the purchase of hearing aids.

- Fitness benefits provide access to fitness centers, home fitness kits, and digital fitness classes.

- Over-the-counter benefits provide a quarterly allowance to spend on health and wellness products. Products can be ordered via a catalog and shipped directly to the member’s home.

- Healthy Food Card allows eligible members with certain chronic conditions to receive a pre-loaded debit card with a quarterly allowance to buy approved foods, such as produce

- Non-urgent medical transportation benefits provide routine and post-discharge transportation coverage to medically related appointments.

- Advanced care at home allows members with certain medical conditions to receive care from the comfort of home including equipment setup, 24/7 phone support and remote monitoring, and prescription delivery. This is an optional service, provided as an alternative to receiving acute care and post-acute care in a hospital to support recovery.