Our care

Medicare is a federal health insurance program that provides health care coverage to millions of Americans who are 65 and older, and people with certain disabilities or health conditions may be eligible before they turn 65. It is designed to protect the health and financial security of those who use it. Medicare is comprised of four parts (A, B, C and D) covering specific services, from medical care to prescription drugs.

- Part A covers hospital and nursing home care, while Part B generally covers physician services. Together, Part A and Part B are called Traditional Medicare and are provided by the federal government. Traditional Medicare covers only about 80% of medical expenses and does not include prescription drug coverage. Beneficiaries must enroll in both Parts A and Part B be to eligible for Part C.

- Part C, known as Medicare Advantage, is another way to get Part A and Part B coverage. Medicare Advantage is offered by private health plans like Kaiser Permanente, and includes an annual out of- pocket cap, reduced cost sharing, and supplemental benefits not covered under Traditional Medicare.

- Part D is voluntary prescription drug coverage that can be combined with Traditional Medicare or included in Medicare Advantage plan design and is available from private health plans like Kaiser Permanente.

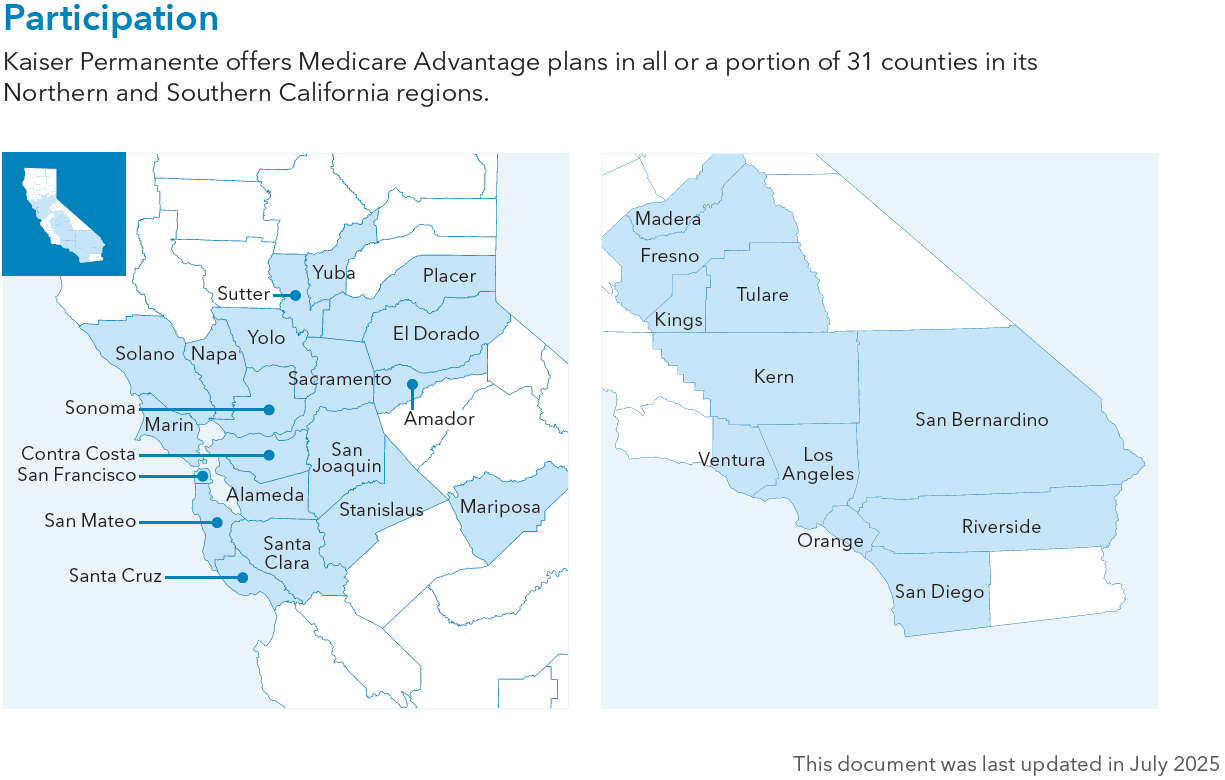

With our integrated care model, Kaiser Permanente achieves better outcomes through a combination of care coordination, comprehensive data collection and use, and aligned incentives that all promote affordable, high-quality care. In most situations, Permanente Medical Groups provide the physician care, Kaiser Foundation Health Plan provides the coverage, and Kaiser Foundation Hospitals provide the medical facilities as well as nursing and ancillary care. In California, we operate 37 hospitals and over 400 medical offices and employ over 18,000 physicians.

Quality

Kaiser Permanente performs highly on measures of quality and is tied for the highest rating of any Medicare individual health plan in the state, per the Centers for Medicare & Medicaid Services (CMS) 2025 Star Ratings. For 2025, Kaiser Permanente Medicare Advantage plan is rated 4.5 out of 5 Stars in California. In addition, according to the National Committee for Quality Assurance (NCQA), we have the highest-rated Medicare Advantage plan in California with a 4.5 rating out of 5.0.

Dual eligibles in Medicare and Medicaid

Dual eligibles are those who are enrolled in both Medi-Cal and Medicare programs, and Kaiser Permanente serves roughly 192,000* dual eligibles across the state. In recent years, Medicare Advantage plans have worked with the state of California to increase enrollment in integrated Dual Eligible Special Needs Plans (D-SNPs), which better align coverage and care delivery of Medicare and Medicaid benefits through a member-centered approach. Kaiser Permanente currently serves over 100,000 individuals through D-SNP plans. *Data is current as of April 2025.

Program spotlight

Kaiser Permanente provides several Medicare Advantage benefits that help improve access to care, affordability, and health outcomes for our members, especially those with the most complex needs. Key California benefits include:

- Virtual care plays a pivotal role in providing convenient care to our members, including talking to your doctor or care team by phone or video from the comfort of home, scheduling appointments, viewing test results and health records, ordering prescriptions, and sending nonurgent health questions to your doctor’s office.

- Access to affordable prescription drugs is critical to supporting the health of many older adults. Our innovative approach to prescription drug coverage and purchasing for our member involves evidence-based medication selection, negotiated drug purchasing, and careful formulary design (list of covered medications). Kaiser Permanente’s integrated model gives us the unique ability to leverage the pharmaceutical supply chain, drug formularymanagement, and pharmacy benefit design to control drug costs. Through these efforts, we achieve up-front discounts when possible, providing our members the best possible value for their dollar.

- Supplemental benefits are items and services that plans can cover beyond those covered under Traditional Medicare, such as dental, vision, and hearing benefits. The specific benefits offered vary by plan.

- Dental, vision, and hearing benefits support overall health and daily functioning. Medicare members receive preventive dental coverage benefits, which typically includes services like routine oral exams, cleanings, X-rays, and more. Medicare members receive an allowance to use toward the purchase of eyeglasses or contact lenses and towards thepurchase of hearing aids.

- Fitness benefits provide access to fitness centers, home fitness kits, and digital fitness classes.

- Over-the-counter benefits provide a quarterly allowance to spend on health and wellness products. Products can be ordered via a catalog and shipped directly to the member’s home. Alternative medicine includes an acupuncture benefit for managing chronic back pain.

- Advanced care at home allows members with certain medical conditions to receive care from the comfort of home including equipment setup, 24/7 phone support and remote monitoring, and prescription delivery. This is an optional service, provided as an alternative to receiving acute care and post-acute care in a hospital to support recovery.