Biosimilars play a critical role in lowering drug prices. Kaiser Permanente successfully uses biosimilars to improve affordability for our members. We are eager to share best practices and work with policymakers to help facilitate a more competitive market for biologic drugs in the United States.

A quick primer on biosimilars

- Biologics are drugs derived from living organisms, and they are used to treat conditions such as rheumatoid arthritis, multiple sclerosis, and some cancers.

- Biosimilars are highly similar versions of the original “reference” biologic that have been proven to show no meaningful clinical differences in safety, purity, and potency.1

- Fostering a robust market for biosimilars to compete with pricier reference biologics could result in savings of over $180 billion over the next 5 years2 to U.S. patients, taxpayers, and health care systems.

- The United States has been slow to approve and adopt biosimilars. As of July 2023, the U.S. Food and Drug Administration (FDA) had licensed 41 biosimilars,3 but only 22 are available to patients. In Europe, more than 80 biosimilars have been approved — and nearly all of them are available.4

Kaiser Permanente’s success story

Leveraging our integrated model, Kaiser Permanente successfully uses biosimilars to improve affordability for patients while saving our system millions of dollars in the process. Contributing factors to our success include:

- Strong prescriber confidence in our formulary, which is evidence-based and developed in partnership by our expert pharmacists and Permanente Medical Group physicians

- A commitment to disseminating and generating unbiased information and data about biosimilars to educate clinicians and support treatment decisions instead of relying on pharmaceutical industry sales representatives as the primary source of information

- Clinician decision-making that is not influenced by drug reimbursement, facilitating financially neutral prescribing based on available evidence

- Close partnerships and communication between physicians, care teams, and patients in making treatment decisions

- A culture of sharing biosimilar success stories across our organization

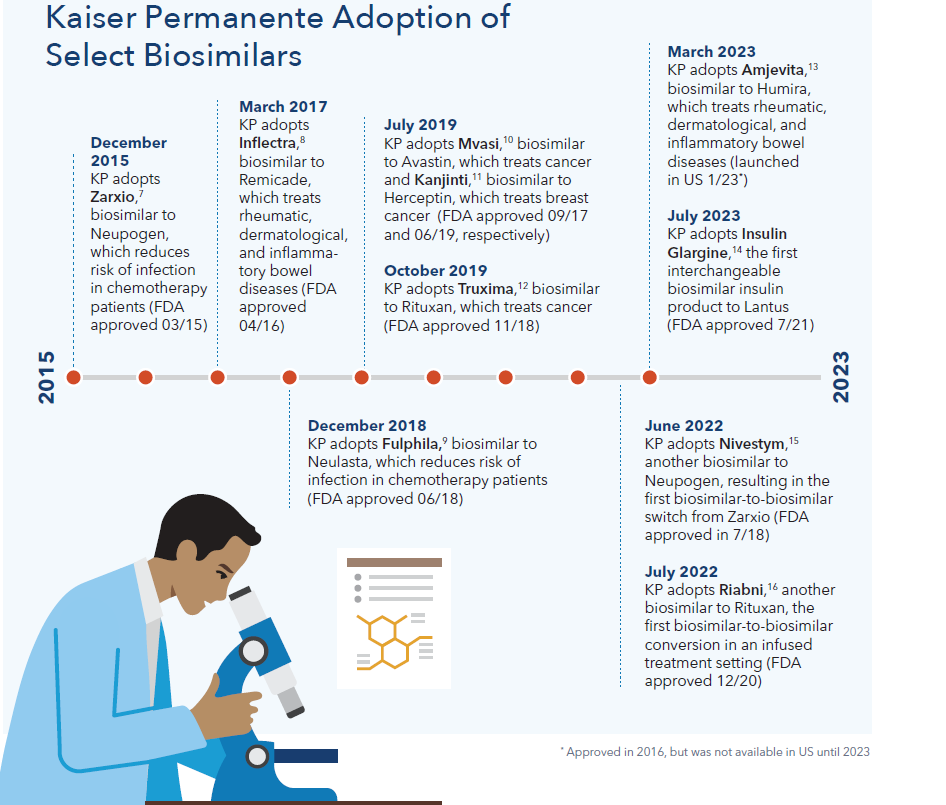

Key examples of Kaiser Permanente’s biosimilar adoption

- We successfully use Inflectra, a biosimilar to the reference product Remicade, over 90 percent (90.2%) of the time. Industry-wide, Remicade biosimilars have only reached 44%5 market share, even though they can be approximately 18% less expensive.6

- In 2019 alone, we achieved 90% biosimilar adoption in just 2 months for Mvasi (biosimilar to the reference product Avastin), Kanjinti (biosimilar to the reference product Herceptin), and Truxima (biosimilar to the reference product Rituxan) compared to 70% adoption outside Kaiser Permanente, resulting in $140 million in cost savings.

- Not only does Kaiser Permanente successfully convert from reference biologics to biosimilars, we also have implemented two biosimilar-to-biosimilar initiatives. We converted from Zarxio to Nivestym in June 2022, and from Truxima to Riabni in July 2022.

- This year, Kaiser Permanente has switched almost 90% of our commercial and Medicare members from Humira, a biologic used to treat rheumatoid arthritis, to the new biosimilar Amjevita. Amjevita offers significant cost savings, with a list price 55% less than Humira. We anticipate realizing up to $300 million in savings this year due to this switch alone.

How policymakers can address ongoing barriers

Kaiser Permanente’s experience demonstrates the potential value biosimilars can deliver to patients and the health care system. But, many barriers still exist that prevent a fully functional biosimilars market in the United States. Policymakers have an important role to play in helping the health care system overcome these barriers and fostering a more competitive market for biologic drugs. Some of the barriers include:

- Over-patenting: Patents are important catalysts for innovation. However, manufacturers use hundreds of patents to block biosimilar competition and maintain high prices far longer than our patent laws intend. These anticompetitive practices should be examined and addressed.

- Lack of access to unbiased information: Some manufacturers engage in marketing campaigns that suggest biosimilars are inferior to reference products. There are few unbiased resources about biosimilars that are readily available to prescribers to counter this misleading narrative. Policymakers can help increase access to clinical data about biosimilars and unbiased educational resources that will help instill confidence in both clinicians and patients.

- Insufficient incentives for adoption and uptake: Converting patients from reference products and overcoming other operational barriers to using biosimilars can be resource intensive. Policymakers may need to provide temporary support to encourage providers to take these steps until a greater level of expertise with biosimilars is achieved.

- Misaligned payment incentives: Potentially insufficient or perverse payment incentives that encourage providers and health plans to prefer more expensive reference biologics over biosimilars should be examined and addressed.

- High bar for interchangeability: Unlike in Europe, in this country a biosimilar product must demonstrate that it produces the same clinical result as the reference product in any given patient in order for pharmacists to substitute the biosimilar without clinician approval — a very high bar called interchangeability status. This designation creates unnecessary confusion and the perception that biosimilars without interchangeability status are inferior, which hinders biosimilar adoption. Policymakers should eliminate the interchangeability designation, or otherwise deem all biosimilars as interchangeable, and allow pharmacists to substitute a biosimilar for a reference product.

Timeline of biosimilar adoption

The biosimilars pathway in the United States is relatively new. In March 2010 the Biologics Price Competition and Innovation Act was signed into law, creating the biosimilars approval pathway. Kaiser Permanente has led the way in adopting biosimilars since the beginning.

Download this issue brief as a PDF.

References

1 https://www.fda.gov/consumers/consumer-updates/biosimilar-and-interchangeable-biologics-more-treatment-choices

2 https://www.iqvia.com/insights/the-iqvia-institute/reports/biosimilars-in-the-united-states-2023-2027

3 https://www.fda.gov/drugs/biosimilars/biosimilar-product-information

4 https://www.ema.europa.eu/en/news/biosimilar-medicines-can-be-interchanged#:~:text=%E2%80%9CEMA%20has%20approved%2086%20biosimilar%20medicines%20since%202006

5 https://www.cardinalhealth.com/content/dam/corp/web/documents/Report/cardinal-health-biosimilars-report-2023.pdf

6 https://jamanetwork.com/journals/jama/fullarticle/2698912

7 https://www.accessdata.fda.gov/drugsatfda_docs/nda/2015/125553Orig1s000TOC.cfm.

8 https://www.fda.gov/news-events/press-announcements/fda-approves-inflectra-biosimilar-remicade.

9 https://www.fda.gov/news-events/press-announcements/fda-approves-first-biosimilar-neulasta-help-reduce-risk-infection-during-cancer-treatment

10 https://www.fda.gov/news-events/press-announcements/fda-approves-first-biosimilar-treatment-cancer.

11 https://www.fda.gov/drugs/biosimilars/biosimilar-product-information

12 https://www.fda.gov/drugs/fda-approves-truxima-biosimilar-rituxan-non-hodgkins-lymphoma

13 https://www.fda.gov/news-events/press-announcements/fda-approves-amjevita-biosimilar-humira

14 https://newsroom.viatris.com/2021-11-16-Viatris-and-Biocon-Biologics-Announce-Launch-of-Interchangeable-SEMGLEE-R-insulin-glargine-yfgn-Injection-and-Insulin-Glargine-insulin-glargine-yfgn-Injection

15 https://www.fda.gov/drugs/biosimilars/biosimilar-product-information

16 https://www.fda.gov/drugs/biosimilars/biosimilar-product-information